GE’s grid size lithium-ion battery container units

I am continually amazed at how casually it is said that the problem of intermittency and unreliability with solar energy can be solved with backup batteries. Does anyone actually look at how many high maintenance backup battery systems in multi-ton container units this would take, how long they would last, and how much it would cost to build, install, and maintain them, and then to replace them in about 15 years?

Two of the biggest grid-scale backup battery makers that I am aware of are GE and Tesla. Both are using lithium ion type batteries in container size units.

There are also iron flow type grid size battery makers. I don’t know the cost of the iron flow system, except I did a study of ESS Tech Inc. last year and found that they were having trouble selling them, presumably because of the high cost. I asked for a tour and an interview, since they’re right here in Oregon. They replied that they are not giving tours, and I have not heard back anything regarding an interview. I notice their stock has gone from a peak of $18.75 on 10/31/21 to $0.79 today, 5/28/24.

Note: In fairness to ESS, they did just land a deal to install an iron flow system at Amsterdam’s airport. Iron flow is safer (they can’t catch on fire or blow up, so the airport liked the idea, even if it cost more) and more environmentally friendly and sustainable than lithium batteries. They also hold a charge longer - up to 12 hours. If this catches on with airports, ESS might do well after all. At $0.79/share, I might even buy some of their stock (GWH) on speculation.

Now let’s look at the lithium ion type grid backup batteries, the kind made by GE and Tesla.

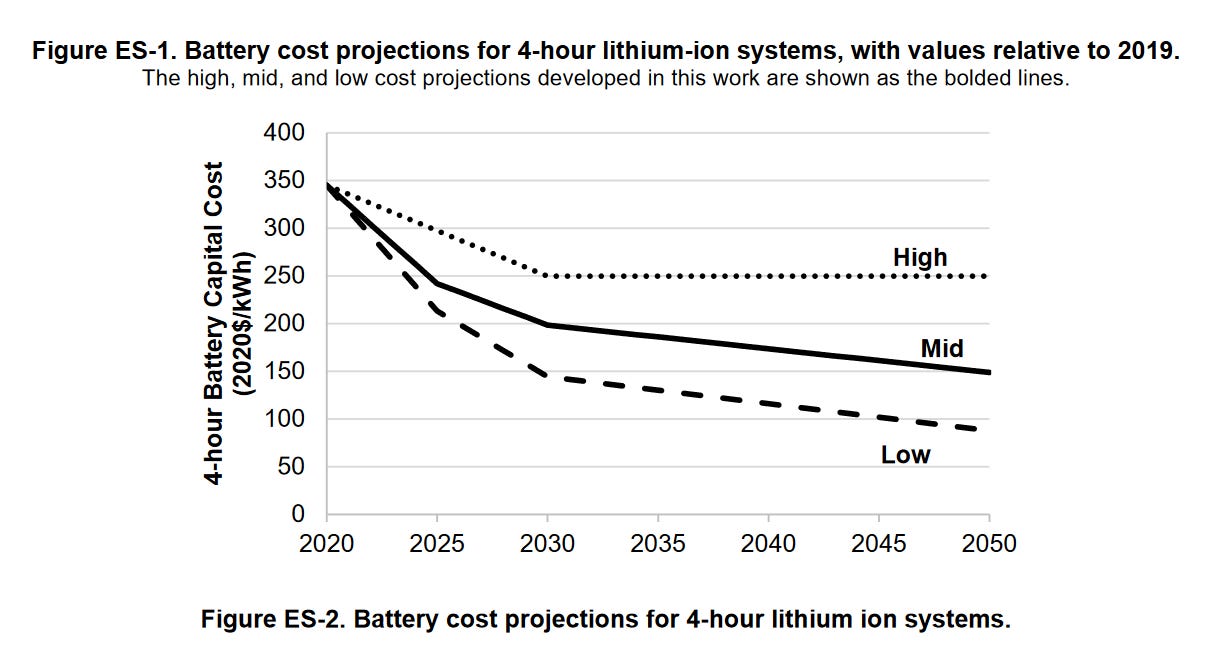

I found this graph in a report from the National Laboratory of the US Dept of Energy (NREL.gov).

The graph shows estimated cost projections for the typical 4 hour backup. We need to adjust for inflation, because these figures were based on the 2020 dollar.

(“$1 in 2020 is equivalent in purchasing power to about $1.21 today, an increase of $0.21 over 4 years. The dollar had an average inflation rate of 4.91% per year between 2020 and today, producing a cumulative price increase of 21.15%.”)

Looking at the mid range, the cost estimates are about $240 per kWh for just 4 hours of storage, or $240 X 1.21 = $290 at today’s prices.

Bear with me, and let’s use this estimate for a 10 MW solar plantation. I’ll assume the 10 MW peak capacity averages 30% in actual practice, and say 8 hours of useful daylight for an average output of 24 MWh/day. Since 1 MW=1000 KW, it would take 24 MWh X 1000KWh/MWh X $290/KWh = 24 Billion X $290 = $6.96 Trillion in 2024 dollars. That’s just for one li’l ol’ solar plantation, and it’s just for 4 hours, with zero power after 4 hours, until sunny weather returns. Zero. Nada. Worthless. A waste of money, if we even had that much money.

Furthermore, if inflation continues at about 4.9% annually, and I think it will, the graph’s estimated mid cost of about $200/kWh in 2030 would be inflated to about $425/kWh, for a total capital cost for each 10 MW plantation of $10.176 Trillion for new backup systems. There’s no way.

They are insane