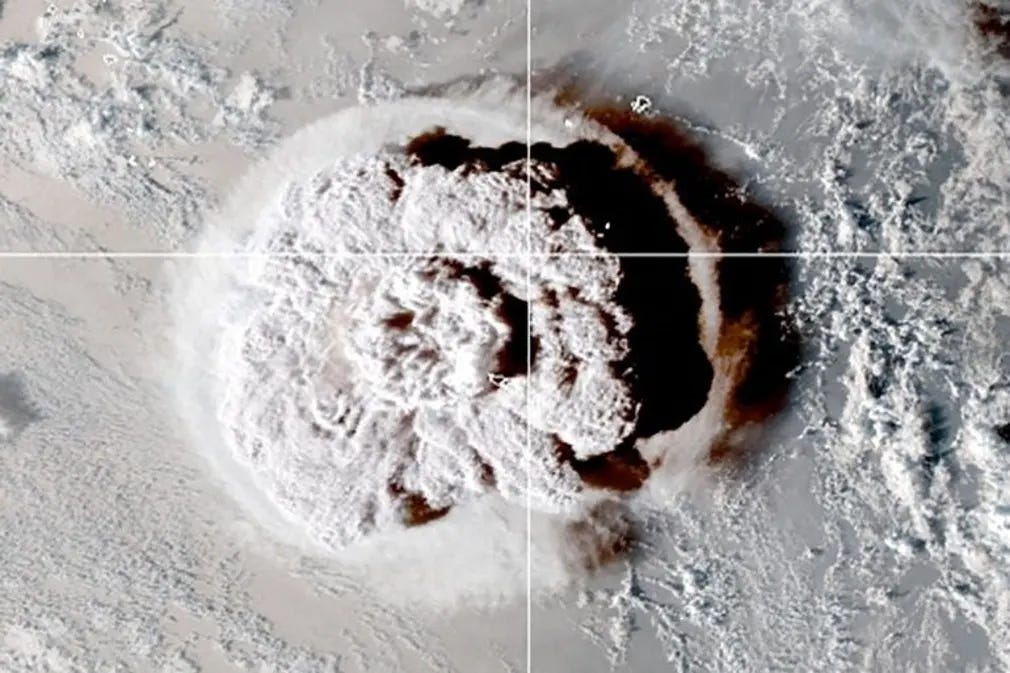

first, about global warming - Hunga Tonga undersea volcano eruption in 2020, as viewed from space

NASA: “When the Hunga Tonga-Hunga Ha’apai volcano erupted on Jan. 15, it sent a tsunami racing around the world and set off a sonic boom that circled the globe twice. The underwater eruption in the South Pacific Ocean also blasted an enormous plume of water vapor into Earth’s stratosphere – enough to fill more than 58,000 Olympic-size swimming pools. The sheer amount of water vapor could be enough to temporarily affect Earth’s global average temperature.

The not only injected ash into the stratosphere but also large amounts of water vapor, breaking all records for direct injection of water vapor, by a volcano or otherwise, in the satellite era. …The excess water vapor injected by the Tonga volcano … could remain in the stratosphere for several years. This extra water vapor could influence atmospheric chemistry, boosting certain chemical reactions that could temporarily worsen depletion of the ozone layer. It could also influence surface temperatures … since water vapor traps heat.”

“We’ve never seen anything like it,” said Luis Millán, an atmospheric scientist at NASA’s Jet Propulsion Laboratory in Southern California.

it gets worse - Jeff Childer’s Coffee&Covid: “Over the next year it would turn out that NASA badly underestimated the amount of water Hunga Tonga vaporized into the atmosphere. Current estimates are three times higher than the original: scientists now think it was closer to 150,000 metric tons, or 40 trillion gallons, of super-heated water instantly injected into the atmosphere. Talk about a greenhouse. Water vapor — humidity — is a much more effective greenhouse gas than carbon dioxide.”

now, an update on a totally different topic - FedNow, CBDCs, the future of crypto, the connection between crypto, the blockchain, and AI, and what you can do to protect your finances

Wisdom in handling our money is part of Christian stewardship. In the parable of the servants given the 10 minas [a Hebrew designation of money] the master told them to “do business until I return”. I take that to mean they were to put that money to work. When Jesus fed 5000 from 5 loaves and 2 fish, He said to gather up the leftovers [12 baskets full!] – not to waste any of it. Today’s post is about seeking insight to ways that will help us to be good stewards and thus enable us to be good givers.

Background – my previous article on CBDCs and FedNow April 6

FedNow

There’s some confusion about FedNow. The official explanation tells us about “instant payment services”:

“The FedNow Service provides liquidity management transfer capability to support instant payment services. The liquidity management transfer enables participants in the FedNow Service to transfer funds to one another to support liquidity needs related to payment activity in the FedNow Service.”

They mean that they are updating the ancient, antiquated clearing house system that takes several days to clear a check in an age when it should only take seconds. It’s about time. But after decades of lagging behind, why all of a sudden the big push?

FedNow is a further centralization of the Federal Reserve Bank, and thus gives the federal government even more control over the banking system, but it’s not a CBDC (central bank digital currency) per se. However, there’s no doubt that it’s part of the transition. I think the big push is because the existing system could never be coordinated with a CBDC which would track and record (on the blockchain, like a permanent, secure ledger) every single financial transaction you and I ever make, from buying gas to donating to our church. The underlying banking system has to be brought up to speed first. That’s why FedNow is happening Now -so the Fed will be able to launch the real thing - a CBDC.

CBDCs (still future but coming very soon)

Jim Rickards, economist and author describes how oppressive a CBDC could become: “CBDCs are not a new currency. They are an existing currency (the dollar) in a new digital form. The form matters. With the Treasury and the Federal Reserve in charge of the digital ledger, they will know everything you’re buying, what you’re reading, what charities you support, what church you go to, and much, much more, all by looking at your payment history. They won’t need to get warrants to look inside MasterCard or VISA. All of the information will be in the government ledgers from the date of purchase. Using artificial intelligence, it will be simple to profile you and decide if you are a loyal supporter of the Biden regime or “an enemy of the people” as Joe Biden sees it. If you’re in the enemy category (Super MAGA), get ready for a knock on the door from the IRS or FBI. As if that were not all bad enough, something worse is coming fast. We call it Biden Banks. Once a bank decides you are unacceptable based on your political opinions, they can close your account. Other banks won’t give you a new account because they’re afraid they’ll be singled out for regulatory violations. When it gets bad enough, you may even have to leave your country because you’re unbanked.”

If you really want to look into this, and you should, Truthstream Media has a 33 minute video that goes deeply into what’s coming and how it can affect us.

I do believe it’s important for us to understand the times so we’ll know what to do:

“…men from Issachar, men who understood the times and knew what Israel should do…” 1Chron.12:32 “Since it was customary for the king to consult experts in matters of law and justice, he spoke with the wise men who understood the times” Esther 1:13 “My people are destroyed for lack of knowledge...” Hosea 4:6

That being said, I confess I’m still not sure exactly what to do with my finances. However, I do know the main thing to do- Trust the Lord; not the State. To Trust the Lord completely means to Trust Him even if all money and assets, home, clothes, and food are lost, leaving us starving and naked and homeless and freezing - because we’re just passing through this world; it’s just temporary, and there’s a much better place, a mansion in the City of Gold, being prepared for those who love Him and remain faithful.

Even though I’m not sure exactly how to prepare for the huge change that’s coming in the national currency, I do have a few ideas.

I wrote the following on April 13th:

“A CBDC, or central bank digital currency, is a whole different animal from paper currency.

“Most everyone has heard of Bitcoin (BTC), the first digital currency, but few people understand that it’s really a software program. Bitcoin is designed, or programmed, to be used as a medium of exchange like money, but built into the program are rules for how its supply can only be increased until an absolute limit of 21 million bitcoins is reached. BTC was created in 2010, and there are now well over 19 million bitcoins, so getting close to the maximum.

“According to buybitcoinworld.com , as of 2023, only 1.3% of the world’s population uses BTC. Still, the number is growing. 89% of Americans have heard of BTC, and 22% own some BTC. There are 270,000 daily bitcoin transactions worldwide.

“We’re used to a dollar simply being a dollar. Our paper dollars lose value over time due to inflation, but at least they have no hidden power to control our lives. They’re just pieces of paper, with a supposed value by “fiat” (government decree). CBDCs will also be “fiat” money. They will be even easier to “print” than paper money, because they won’t even need the paper or the ink! Digital dollars, being programmable, will be designed and drawn up by the woke lawyers in the administration. Not only that, but the software will be subject to change whenever and however the state wants to change it, just like they make changes all the time to all their other rules and regulations. (Thank goodness for TurboTax)

“Social Security or welfare money could be posted to your bank account with a simple click. But that same awesome power could be used against you. Your bank account could be wiped out with a simple click, too, if that’s what they really wanted to do. What would stop them? Not the constitution. We know how little respect they have for that.

“Let me give you an example. Suppose the feds decide they don’t want anyone to buy gas-powered cars. Out of concern for the ‘environment’, they could program your digital dollars to be unusable for buying any cars with gas engines. You just wouldn’t be able to buy them. Or your dollars could be programmed so that only certain privileged people could buy gas cars. Others could be “blacklisted”. That’s the way totalitarian states have always acted.

“There’s a trend I’m sure you’ve heard of that rewards those who are “woke”, which is a collective term for all the things the radical left likes. Anyone who isn’t woke gets punished. Those are the people who would eventually get blacklisted. Some people, if deemed “enemies of the state”, could even be cut off completely, so that their digital dollars would be useless; that is, they would not be able to buy or sell anything. A digital dollar would be an incredibly powerful extension of the state’s ability to control the whole population to a much greater extent than they did with the covid mask and vaccine mandates.

“I know this all sounds crazy and extreme almost beyond imagination, but it’s coming, and very soon. I hope I’m wrong.

“You may find yourself blacklisted and your ability to buy or sell restricted. In case that happens, do your best to be prepared for it, not only for your own good, but so that you’ll be in a position to help others who might be blacklisted or who might just be having a hard time because of inflation or a depressed economy.”

alternative stores of value

Governments have come and gone throughout history, and their currencies have come and gone with them. Alternative stores of value have stability that has withstood the test of time. Land will always have value, but it’s not portable, so you can be removed from it, as any student of history knows only too well. Gold will always have universal value anywhere in the world, and it is portable and can be used as a medium of exchange, but it’s not easily used for daily purchases, and it can be confiscated.

The newest alternative is cryptocurrency, which is untested, but worth looking into. Some are calling Bitcoin “digital gold” and saying it’s better than gold. Like gold, crypto is global and should have the same value anywhere in the world, since it’s borderless. There are thousands of cryptocurrencies, and they can be fraudulent; not backed by anything and some of them can be “printed” digitally even easier than fiat paper currency can be printed, to the point of becoming worthless over time. Fortunately, the more reputable ones, like Bitcoin, can NOT be produced in unlimited amounts. In fact, Bitcoin in particular has a built in restriction preventing the production of more than 21 million ‘coins’.

But there are several variations of crypto that have value because they have utility. Bitcoin (BTC) is a digital currency that cannot be inflated because it is actually a software program that has built in rules. The two main rules are that it is ingeniously secured by the blockchain and that the number of coins “minted” will never be more than 21 million. [It’s getting close to that limit.] BTC has utility because it can be designated in units to 8 decimals, making it extremely flexible as a medium of exchange. Since every transaction is verified and secured by the blockchain, I don’t see how it could ever be counterfeited.

There are several reasons why BTC hasn’t replaced fiat currency (yet). It doesn’t have enough history to be considered ‘time-tested’, it’s neither easy nor necessary to establish an account (unlike the need for a checking account in dollars), and it’s encountered a lot of bad publicity by old school naysayers. The two main criticisms are that it’s “backed by nothing” and that the State will probably not allow it to replace its own currency.

The “backed by nothing”, or “it’s not real” (unlike gold) argument is weak, because of the reasons given above – it has utility, with many advantages. Hundreds of merchants, vendors, services, and individuals will accept BTC now as a medium of exchange. It’s being tested and is holding up well.

The argument that the State won’t allow it is a real risk, but it may be just as hard for the State to stop it as it is for the State to stop the internet.

Bitcoin is not the only type of crypto that has value. Ethereum is not a cryptocurrency per se. It is more like an operating system; a software app that is designed to be a platform for innovators to build new decentralized digital applications (“dApps) that will streamline or improve all kinds of operations and contracts.

Ethereum is an open-source, decentralized blockchain network whose use cases go beyond digital payment.

Ethereum, the first smart contract platform, launched in 2014. Thousands of dApps (“d” for decentralized) run on, or are compatible with, the Ethereum Virtual Machine — the computational engine behind Ethereum. “ETH” is the digital coin used on Ethereum dApps. Ethereum complements the true vision which led to the creation of Bitcoin with a focus on creating a decentralized platform where developers could build other blockchain solutions. These are called projects because they are similar (in my opinion) to new business startups. Some of them will fail, but I think some will become huge successes in the future. Each project gains funding by selling its own digital coin. The projects that are successful will see the price of their respective coins go up, just like a successful conventional business startup can see its stock price go up.

Again, Ethereum and others like it have utility. There is real value here. The Ethereum platform’s digital “coin”, or token, ETH, is the ‘currency’ for use within its own system and on its own platform. Since ETH can be bought with fiat currency like US dollars (or any other nation’s currency), Ethereum is financed by the sale of ETH.

examples of actual use cases built on the Ethereum platform

From https://coinmarketcap.com/alexandria/article/ethereum-top-10-biggest-projects

“…how could we mention Ethereum without decentralized finance (DeFi). Ethereum was built as a "world computer," the first blockchain to feature smart contract functionality.

Smart contracts are algorithms programmed to self-execute once preset conditions are met. That's how smart contracts allow us to decentralize traditional financial instruments as much as possible, thus rendering a central authority redundant. This also means that we, the little people, get access to instruments that were reserved for financial institutions in the past.

So to help you make the most out of your digital assets, let's talk about some of the most impactful DeFi protcol in the Ethereum ecosystem.”

1. Curve Finance is an automated market maker (AMM). Unlike other DEXs, (decentralized exchanges) it differs on one fundamental level: It favors stability over volatility and uncertainty. In other words, Curve Finance is an amazing way to earn a stable and consistent yield on your safe bets. So you can treat Curve as a DeFi savings account of sorts. Curve Finance is something special. It offers the cheapest transaction fees, and the lowest levels of slippage and impermanent loss. And how is Curve able to achieve these feats? Why, by organizing liquidity pools around assets that behave in a similar manner (e.g., stablecoins and BTC and wrapped BTC).

2. Brave is a new and rapidly growing web browser. What makes the Brave browser different is that it gives its users the option to view ads. (Or not.) And should you choose to view them, you'll be rewarded with Basic Attention Tokens (BAT). At today's value, they're not worth much, but hey, it's better than Facebook getting that money, eh? (I use Brave sometimes.)

3. Aave is a decentralized lending protocol that first launched in 2017 as ETHlend via an initial coin offering (ICO). What makes Aave unique is that it sets its interest rates based on the utilization rate of the liquidity pool in question. You don't have to borrow in kind! So if you deposit ETH, you can borrow another crypto asset. Oh, and AAVE is the native governance token, which you can use to vote on the direction of the protocol.

4. Uniswap is an Ethereum-based decentralised exchange that allows you to take complete control of your funds without intermediaries. With an automated liquidity protocol trading model, Uniswap allows you to send and receive cryptocurrencies without passing through any third party.

5. Aragon allows you to create global, bureaucracy-free companies and freely organize and collaborate without borders or intermediaries.

6. InsurAce is a multi-chain protocol that provides insurance services to DeFi users, allowing them to protect their investment funds against various risks.

7. Identity.com is an open source ecosystem providing access to on-demand, secure identity verification.

overview of crypto and its future

Although crypto currencies have been plagued by volatility, speculation, and even fraud, I would expect that many folks will be very interested in looking for a way to protect their finances from the ravages of the big banks and the federal government’s totalitarianism. I’ll be following very closely to see what the alternatives are. Bitcoin and Ethereum and some others have been gradually gaining traction as a medium of exchange. I mean direct exchange; where a merchant or vendor accepts Bitcoin instead of US fiat dollars, bypassing the traditional banking system. No doubt there will be legal battles over this. Because of the universal, global utility of crypto and the internet, it may be impossible for a government to shut down this trend, but of course they will try.

connection with the blockchain

The blockchain is a secure, decentralized (not under the control of any individual or company or government, but instead spread out over thousands of computers that can verify every transaction) ‘bookkeeping system’. No need for a bank statement, for example. One of the confusing terms associated with the blockchain is “trustless”. I wish they’d come up with a better term; the word “trustless” is kind of scary. But what is really meant is that you don’t need to trust any individual or institution, like a bank, to “trust” that the transaction is valid, or that the “money” (in the form of crypto) is actually in the account. So the blockchain records are “trustless” in the sense that you don’t need to trust any human person or institution. Blockchain is great because fraud and counterfeiting*, forged checks, embezzlement, etc, should become non-existent. If you buy something with Bitcoin, the blockchain’s thousands of computers spread all over (decentralized) will immediately verify that you have enough Bitcoin in your wallet to make the purchase. Then the transaction will be finalized and recorded, also in seconds (or longer if there’s a lot of ‘traffic’ on the net and the chain.) *BTC cannot be counterfeited because it’s not printed - it’s “mined”. It is so expensive to mine new BTC, which takes huge computer power, that there is no guarantee of any profit.

connection with Artificial Intelligence/AI

One of the greatest advantages of crypto is not the “coins” or currency. It’s the way software programs and contracts can be built and secured with the blockchain. And of course Artificial Intelligence is already being used all through the newest software projects.

what you can do

All investments have risk, and you shouldn’t invest in something you don’t understand, so if you’re interested in crypto as an alternative and as a possible protection against the CBDCs that are in the near future, the first thing you should do is educate yourself. Then, stick your toe in the water for a start. Open a cryptocurrency account on an exchange like Coinbase and buy a little BTC.

caution

Pay your taxes. If you get more active and buy more crypto, and then sell some at a profit, you will owe capital gains tax. Also, Coinbase can be hacked. Learn how to protect your BTC by moving it off the exchange into a secure digital “wallet”. If your investment becomes sizable, go one step further and move it into a “hardware” digital wallet - a physical encrypted secure physical storage device.

publishing “My Two Cents” once a week, every Thursday. Next week - TBD (to be determined)